It’s back. After years of frustrating restrictions, international transactions on Naira debit cards are finally here. For many Nigerians, this isn’t just financial news; it’s deeply personal. Whether you’re a small business owner, a freelancer, or a student paying for a foreign certification, this shift marks a turning point. But as the excitement grows, one question remains: are the limits fair for using a Naira debit card for international payments?

Let’s break it down.

The Big Reboot: What Changed?

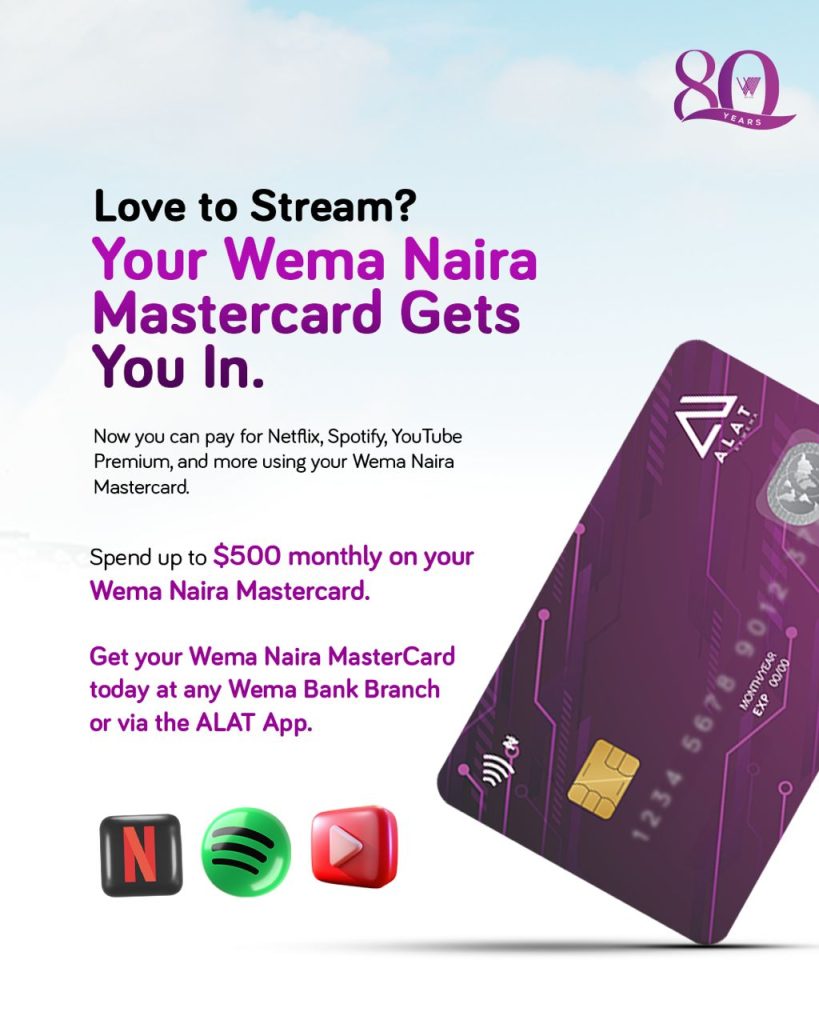

In July 2025, three major banks: United Bank for Africa (UBA), Wema Bank, and Guaranty Trust Bank (GTB) announced the resumption of naira debit card for international payments. This means you can now use your regular Naira card to shop online, stream Netflix, pay for subscriptions, and even withdraw cash overseas. For years, such transactions were blocked due to forex instability and poor policy decisions, including the infamous suspension under the Buhari administration.

UBA re-enabled international use for its premium Naira debit cards without extra activation steps. Wema announced a $500 monthly cap and encouraged users to activate foreign transactions via its app. GTBank set a quarterly limit of $1,000, with $500 allocated for ATM withdrawals. These changes signal cautious optimism but also raise eyebrows.

What the Limits Look Like

Wema’s $500 monthly limit and GTBank’s $1,000 quarterly cap mean many users still won’t be able to make large payments for services like online courses or digital tools. Although UBA didn’t specify a hard cap, its product page suggests a $1,000 ceiling, which remains ambiguous.

So, yes Naira debit card for international payments is back, but with conditions. As @b_plentie commented, “Hope the FX limits are reasonable and not just symbolic.”

Public Reactions: A Mix of Cheers and Sighs

Reactions online reflect the emotional weight this change carries. @Olawaleakinkun4 tweeted, “Nobody happy reach me after the news broke out. Did you know how many certifications I would have obtained if our card could perform a dollar transaction?”

Others like @_simonjnr didn’t hold back: “Suspending international transactions on Naira cards is one of the worst decisions Buhari ever made.”

Then there are the skeptics. @BigtegaTV joked, “Same banks that couldn’t let us pay $1 on Apple Music last year now want to go global again? Hope this isn’t just audio announcement.”

Political undertones also came in hot. @aderemiofficial used it to score points for the current government: “If you love this good news and it will ease your transactions, I advise you to change your mantra to ‘TINUBU CONTINUITY’.”

Also Read: Halt ATM Charges Hike, Reps to CBN

Behind the Curtain: FX, Charges, and Where It Works

Now that Naira debit card for international payments is back, what should you know?

- FX Rates: Transactions are converted at Mastercard or Visa exchange rates. These are usually close to the parallel market rate since the CBN scrapped dollar subsidies.

- Charges: So far, no banks have announced new fees. Most still charge the equivalent amount in Naira plus VAT.

- Activation: For UBA and GTB, your card should work out of the box. Wema users need to toggle the setting via USSD or the ALAT app.

- Merchants: All major international platforms like Amazon, Netflix, Spotify, and even PayPal (as hoped by @Nwaorgu Godslight) should now be supported.

But it’s not perfect. Some users, like @Igwe Oluji, say their cards still don’t work for app publishing abroad. This shows implementation may be inconsistent across platforms or account types.

So, Are the Limits Fair?

Let’s be honest: restoring naira debit card for international payments is a win. It removes one of the most frustrating financial roadblocks for Nigerians in the digital economy. But are $500/month or $1,000/quarter enough in today’s world?

Probably not. Many legitimate business and educational expenses exceed those caps. As @paynedre1 noted, “Restoring international transactions on Naira cards shows confidence returning to the financial system. Step by step, Nigeria is moving forward.” Still, that step feels a little small for people trying to scale startups or access global services.

The real test will be consistency, transparency, and expansion. Will these limits increase with time? Will banks communicate FX rates clearly? Will this ease doing business for the average Nigerian?

Who Feels the Pinch? Sector-by-Sector Impact

Freelancers & Remote Workers

This group arguably feels the weight of these limits the most. Freelancers who subscribe to platforms like Adobe Creative Cloud, Zoom, Upwork, LinkedIn Premium, or even basic hosting services often rack up $100–$200 per month in essential subscriptions. For some, just one client subscription tool like Canva Pro or SEMrush could eat up half the $500 limit.

A tech founder tweeted:

“You will just be at home thinking of how to scale your company… one policy and your entire business model is in shambles.” — @daminister14

This illustrates the frustration of digital entrepreneurs who operate in global markets but remain restricted by local policy choices.

2. Students & Online Learners

From Coursera and Udemy to GRE, IELTS, and international certifications, Nigerian students now depend more than ever on global e-learning. Unfortunately, many courses cost upwards of $100 or more. A Wema Bank card with a $500 monthly ceiling might work for one or two key payments but certainly not an entire semester’s worth of courses.

“Did you know how many certifications I would have obtained if our card could perform a dollar transaction?” @Olawaleakinkun4

The resumption is welcome news, but the real issue is sustainability. Students need flexible, uncapped access to knowledge.

Tech Startups & App Developers

App creators who host their platforms on AWS or Google Cloud or pay for developer accounts on the App Store or Play Store face serious bottlenecks. Many of these services deduct charges automatically in dollars and if the bank blocks the payment for exceeding limits, it can bring the business to a halt.

“Are we really ready for this? Same banks that couldn’t let us pay $1 on Apple Music now want to go global again?” @BigtegaTV

The skepticism isn’t unfounded. Developers need stable, uninterrupted access to their infrastructure not a ticking dollar cap.

E-commerce & Everyday Consumers

Regular Nigerians buying from AliExpress or subscribing to Spotify may find the $500 monthly limit sufficient — if they fall into the casual user category. However, high-volume shoppers or those managing family accounts quickly realize that these limits don’t stretch far.

Add in fluctuating FX rates and you’ve got a recipe for frustration, especially when services auto-renew and suddenly fail.

Digital Creatives & Influencers

YouTubers, content creators, and influencers often spend money on promotion, editing software, or social media tools (like Meta Ads). These creators depend on global services to boost visibility. Limits restrict their ability to scale or even stay competitive.

A Work in Progress

Restoring Naira debit card international payments doesn’t fix everything overnight. But it’s a start. Nigerians are hungry for tools that empower them to engage globally, and this move cracks the door open.

Still, it’s fair to ask for more. Fairer limits. Clearer terms. And above all, consistency.

So, what do you think? Have you tried using your Naira card internationally yet? Did it work? Are the new limits helping you or holding you back?

Share your experience. Because in the end, policies only matter if they work for the people they’re meant to serve.